Chip Mounter Industry 2024: Growth & Competition

Chip Mounter Industry 2024: Growth & Competition

Chip mounter, a high-end precision equipment, plays a crucial role in the electronics manufacturing industry, mainly used for the mounting process of electronic components.

Current Situation of the Chip Mounter Industry

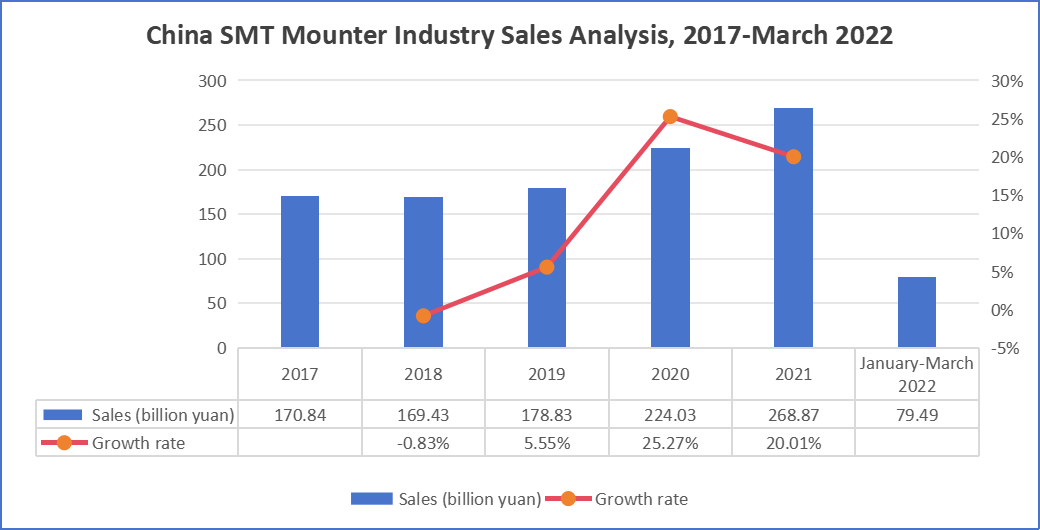

With the rapid development of China's electronics industry, the market size of the chip mounter industry in China continues to grow. Data analysis of the chip mounter industry's current situation shows that from 2015 to 2018, the market size of the chip mounter industry in China increased from 95.18 billion yuan to 174.15 billion yuan. By 2023, the market size further increased to 218.5 billion yuan. Over the past decade, several domestic research institutes have conducted research on chip mounters, achieving certain research results. With the technological progress and development of domestic enterprises, the average price of chip mounters in the Chinese market has gradually decreased. In 2023, the average price of chip mounters decreased from 438,800 yuan/unit in 2018 to 328,000 yuan/unit.

From the perspective of regional markets, China and the Asia-Pacific region are experiencing rapid growth in the SMT chip mounter market. These regions have witnessed rapid development in the electronics manufacturing industry, leading to a significant increase in demand for SMT chip mounters. Especially in China, with the rise of domestic electronics manufacturing and the promotion of policies such as "Made in China 2025," the chip mounter market has encountered unprecedented development opportunities.

With the continuous development of electronic products, Surface Mount Technology (SMT) has become one of the core technologies in the electronics manufacturing field. SMT chip mounter is the key equipment for surface mounting, and its performance directly affects the quality and production efficiency of electronic products. The future development trend of chip mounters can be summarized as "high performance, high efficiency, high integration, flexibility, intelligence, greenization, and diversification."

Driving Factors of the Chip Mounter Industry

Technological Progress: With the continuous advancement and innovation of technology, the technology of chip mounters is also continuously improving. High speed, high precision, and high reliability have become the development trends of the chip mounter industry. The introduction of new technologies and processes has significantly improved the production efficiency and mounting accuracy of chip mounters, meeting the market's demand for high quality and efficiency.

Growing Demand for Electronic Products: The increasing demand for electronic products such as smartphones, tablets, and electronic cars has driven the development of the chip mounter industry. The miniaturization, lightweight, and increased functionality of electronic products require higher mounting accuracy and efficiency, thus driving the improvement and application of chip mounter technology.

Cost-effectiveness: The chip mounter industry's current situation analysis mentions that chip mounters have a high degree of automation, which can greatly reduce labor costs and improve production efficiency. This is very attractive to electronic manufacturers as it can lower production costs and enhance product competitiveness. Therefore, cost-effectiveness is one of the important factors driving the development of the chip mounter industry.

Market Competition Pressure: In the electronics manufacturing industry, there is fierce market competition, with increasing demands for product quality and delivery cycles. As a key production equipment, the performance and stability of chip mounters have a significant impact on the efficiency and quality of the entire production line. Therefore, in order to meet market demand and maintain competitive advantage, enterprises must continuously update and upgrade chip mounter equipment.

Environmental Regulations Promotion: The global focus on environmental protection is increasing, and related regulations and standards are also strengthening. The chip mounter industry needs to adapt to and comply with environmental regulations, promoting green manufacturing and sustainable development. For example, using energy-saving technologies, environmentally friendly materials, and reducing waste, these environmental factors are also driving the development and innovation of the chip mounter industry.

In summary, technological progress, growing demand for electronic products, cost-effectiveness, market competition pressure, and the promotion of environmental regulations are key factors driving the development of the chip mounter industry. With the continuous development and technological innovation of the electronics industry, the chip mounter industry is expected to continue its steady growth.

Chip Mounter Industry Competitive Analysis

In recent years, the prices of chip mounters in the Chinese market have remained relatively stable but have generally decreased. This is mainly due to the technological progress of domestic enterprises and the enhanced bargaining power brought by the increase and concentration of SMT production lines in China. According to the in-depth research report on the operation trend and investment planning of China's medium-speed chip mounter industry from 2020 to 2025, the average price of SMT chip mounters in China was 531,800 yuan/unit in 2016 and 415,300 yuan/unit in 2020.

As the global chip mounter market enters the "China era," major foreign SMT equipment suppliers such as chip mounters, printers, and reflow soldering furnaces have set up manufacturing bases in East China and South China to implement the localization strategy of chip mounter equipment manufacturing. Although each company adopts different strategies and invests with different intensities over time, they share a common market goal, which is to have long-term optimism about the prospects of the Chinese and Asian markets, closely follow Chinese customers, seize opportunities for localized services in production and procurement, reduce product and operating costs, and improve enterprise competitiveness. Now, let's understand the situation of four major enterprises in 2023 through the following.

1. Panasonic Electric

As the exhibition and training base for chip mounter equipment, Panasonic FA Center was established in May 1996. In January 2005, it merged to form Panasonic Electric Machinery (China) Co., Ltd. (PICH), headquartered in Shanghai. The FA Division provides various consulting and technical support to SMT, AI, and semiconductor assembly users in East China, North China, and Central China. In November 2005, Panasonic's Suzhou production technology company, located in Weiting Town, Jiangsu Province, officially launched mass production of chip mounters assembled in China.

2. Siemens

Siemens established an SMT exhibition and training center in Pudong, Shanghai, as early as March 2000. In March 2001, the handover ceremony for the delivery of 10,000 chip mounters was held at Waigaoqiao, Pudong, Shanghai. In 2003, a technical center was established in Shanghai to provide maintenance for feeders and mounting heads, refurbishment of chip mounters, and repurchase business. In April 2005, the Tongji University Sino-German College - Siemens SIPLACE SMT Advanced Technology Research Laboratory was established. Siemens was the first to jointly cultivate advanced SMT technical talents with Chinese universities. Currently, Chinese customers account for approximately 50% of Siemens' total sales.

3. ASM Pacific Technology (ASMPT)

As a leading global supplier of SMT chip mounters, ASMPT is striving to make China its research and development hub. On April 13, 2005, the "ASM Pacific Technology China Technical Capability Center" was officially launched in Waigaoqiao, Shanghai. This 2,000-square-meter technical center will be managed by Chinese managers and will implement localization measures for research and development and manufacturing while also implementing localization measures for talent and management. Currently, ASMPT's sales in China account for approximately 80% of the company's Asia-Pacific business.

4. Universal Instruments Corporation

In May 2002, Universal Instruments invested over $1 million to establish a 6,000-square-foot technology center in Suzhou, and in 2005, it relocated to a new site for large-scale expansion and improvement. As a globally operated supplier, Universal Instruments meets different regional localization requirements, including decision-making, procurement, and service localization. The company has experienced the direct benefits of manufacturing in China—lower costs and shorter delivery times. After several years of development, it has proven that this strategy is successful.

Policy-driven demand growth in the chip mounter market has kept demand for chip mounters steadily increasing. Currently, once domestic chip mounter companies successfully develop new products, foreign chip mounter companies immediately lower prices to suppress domestic chip mounter companies, leading to the interruption of the domestic chip mounter companies' research and development funding chain, making it difficult for them to survive in the constantly changing chip mounter market competition.